TRAFXS Systems

- Home

-

Products

- TRAFXS Systems - General Ledger

- TRAFXS Systems - Accounts Payable

- TRAFXS Systems - System Administration

- TRAFXS Systems - Accounts Receivable

- TRAFXS Systems - Contract Management

- TRAFXS Systems - Contract History

- TRAFXS Systems - Pricing

- TRAFXS Systems - Invoicing

- TRAFXS Systems - Exchanges

- TRAFXS Systems - Movement Recording and Processing

- TRAFXS Systems - Tax Reporting

- TRAFXS Systems - Rebates

- TRAFXS Systems - Credit Processing

- TRAFXS Systems - Ticket Matching

- TRAFXS Systems - Financial Report Writer

- Documentation

- Whole Site

Home

Solving Data Processing Problems

Solving Data Processing Problems

What is TRAFXS Systems?

TRAFXS Systems is dedicated to the continued

development, installation, and maintenance of integrated software

applications for the petroleum industry. We provide a complete suite of

accounting and operational applications, consulting, project

management, installation, maintenance, and system integration services.

Contact TRAFXS Systems

TRAFXS Systems

18 Technology Dr., Suite 130

Irvine, California 92618

Voice: (949) 753-8868

Fax: (949) 450-1242

TRAFXS Systems - Company Overview

Company Overview

What we do...

TRAFXS Systems is dedicated to the continued

development, installation, and maintenance of integrated software

applications for the petroleum industry. We provide a complete suite of

accounting and operational applications, consulting, project

management, installation, maintenance, and system integration services.

TRAFXS Systems actively markets TRAFXS, a fully-integrated product movement and accounting system developed specifically for the oil industry. TRAFXS stands for Trading, Refining, Airline Fuel eXchange System. The applications have been in operation since 1990 in the refining and marketing segment of the oil industry.

TRAFXS runs in any UNIX-compatible environment, with

either character-based or graphic (X-Windows) clients. The applications

are written in 4C, a powerful UNIX-based fourth-generation development

language.

Our Focus and Objectives

The market for the TRAFXS

application suite includes refining and marketing organizations,

traders, gas distribution and crude operations organizations. the

company's stated goals include increasing the scope of our existing

application set to provide a broader customer base in the oil industry.

The TRAFXS Systems project team is highly focused and dedicated to the continued development of TRAFXS and its related support organizations.

Who we are...

TRAFXS Systems has over 80 years of combined

experience in systems development, project management, installation,

maintenance, and system integration activity. The organization believes

in the importance of a string, dedicated project team whose goals are

to assist organizations in streamlining their data processing

operations while utilizing the most advanced tools in the market.

Principals

-

Dennis Noon

TRAFXS Systems - Approach

Our Approach to Solving Data Processing Problems

Overview

Welcome to TRAFXS. We develop and implement

computer systems that provide tremendous benefits to our

petroleum-industry clients. In this brochure, we introduce some very

special application software, describe some of the functionality of

these applications, and identify several of their more prominent

features.

We also hope to convey the more subtle benefits

of TRAFXS. Our development tools, our overall approach to user

satisfaction, and our determination that your investment with TRAFXS

will be protected, will grow along with your company, and will provide

service for many years to come.

We appreciate any time you spend evaluating how TRAFXS can solve the data processing challenges in your organization.

User Orientation

Our entire approach is geared toward satisfying

the needs of the people we serve; making their workdays more

productive, and their jobs easier to perform. Our application

integration philosophy allows individuals, departments, and even

company divisions to work together more efficiently, accurately, and

productively.

Application Maintenance

Most of the cost of software applications occurs

not during their purchase or development, but during their lifetime of

use. The problems that software is designed to solve often change, and

so the software must change as well. We have solved this classic

dilemma in two distinct ways.

First, our applications are parameter-driven.

Very little is hard coded into a program. For example, adding new

payment codes, locations, and prices involves nothing more that

entering data into a table. This flexible design philosophy has evolved

through years of experience in development of vertical applications.

Second, our applications have been developed

using a unique 4th-generation language that reduces the labor involved

in software maintenance and enhancements as much as 80%.

TRAFXS provides its clients with source code and

our complete development environment. We continue to work in

conjunction with your data processing staff to ensure quality support

of the applications and users.

Portability

These tools allow us to take advantage of `open'

systems and to easily migrate our software between platforms.

Currently, TRAFXS runs in any UNIX, MS-Windows terminal emulation, or

X-Windows environment without changing the source material. The

development tools are kept up to date so the applications themselves

can benefit from new hardware, software, database and network

technology.

Portability is a fundamental factor in protecting

the investment made in software and data. Our development tools are

moving into the future with Windows/95, Windows/NT, and ODBC. TRAFXS

clients can mix and match applications servers, database servers,

client/server configurations, and dumb terminals.

Features, Features, Features . . . .

Read on! These applications have a lot to offer.

While we can't possibly present the whole system here, we have provided

a comprehensive overview. In addition, we welcome opportunities for

software customization and development of new or related applications.

Remember, our objective is user satisfaction!

Products

TRAFXS Systems - General Ledger

General Ledger

TRAFXS General Ledger Solution

The TRAFXS General Ledger subsystem is completely

integrated with several other subsystems within the application,

including Invoicing, Accounts Receivable, Accounts Payable, Rebates,

and Exchanges. Transactions are moved to the general ledger only after

both a detail and summary list of the journal are printed.

The General Ledger subsystem supports complete

multi-company and intercompany accounting. Reports (including financial

statements) may be produced for a single company, multiple companies,

or a consolidation of multiple companies.

General Ledger Account Code's Four Segments

-

Company - 2 characters

-

Major - 2 characters, e.g. Sales, Purchases

-

Intermediate - 4 characters, e.g. Location

-

Detail - 4 characters, e.g. Product

Both dollar and volume accounting are supported within the package. Accounts requiring volume retention are flagged.

The G/L subsystem contains a fixed-assets

accounting package, which supports several depreciation methods

(straight line, declining balance, double declining balance, and

MACRS). The package also includes a very flexible G/L coding structure

for assets, deprecation allowances, and depreciation expenses.

Additional Features

-

Automatic reversing journal entries from prior periods. Typing the same journal entry twice, in separate periods, is no longer necessary.

-

A flexible 4-year fiscal calendar, during which all data retained is available for inquiry or reports in both detail and summary form.

-

Prior period adjustments, even to periods in a prior calendar or fiscal year, may be posted at any time.

-

Extensive inquiry facilities, allowing the user to review monthly balances, budget values, and transaction detail for any requested account.

-

All data stored within the G/L system is available to the Financial Report Writer package, regardless of period, account, or transaction type.

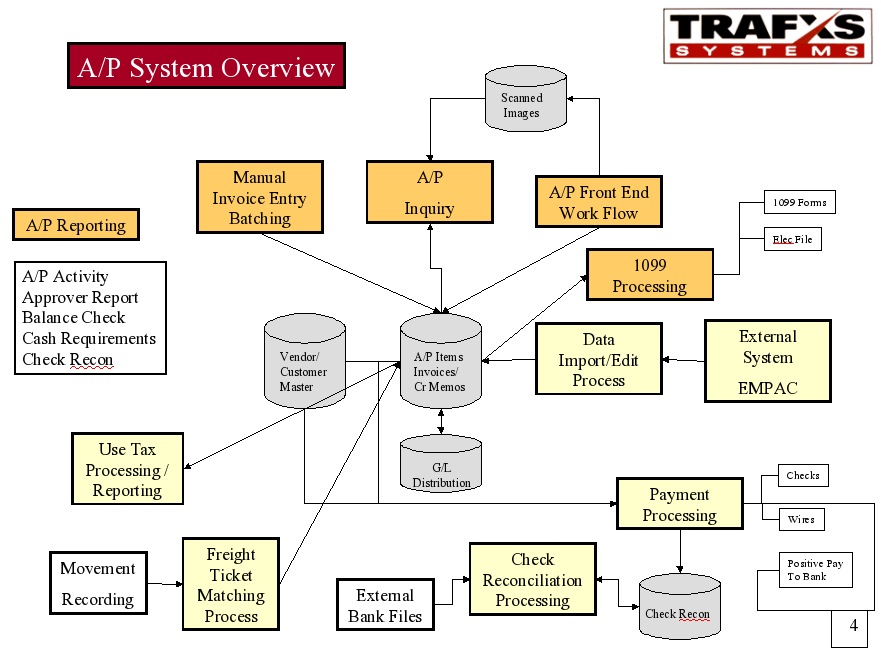

TRAFXS Systems - Accounts Payable

Accounts Payable

TRAFXS Accounts Payable Solution

TRAFXS features a complete, flexible Accounts

Payable system which is completely integrated with its General Ledger

package. This system was designed to encompass all the features found

in the most common A/P packages now in use.

Both invoices and credit memos are easily posted,

along with their general ledger distributions. Intercompany

transactions automatically generate offsetting entries to retain the

G/L balance in each company.

Payment processing has been designed for

flexibility. Invoices may be selected for payment individually, by

vendor, by vendor type, by due date, or by discount date.

Checks can, of course, be printed by the system.

However, wire transfers, as well as handwritten check processing, are

also supported. The A/P system also permits definition of multiple

checking accounts, an invaluable feature in a comprehensive,

multi-company package.

The Accounts Payable system also contains a Check

Reconciliation package, which is used in conjunction with a bank

statement to determine actual cash-on-hand. The package includes an

inquiry program which lists outstanding checks for a specific vendor.

Additional Features

-

Multiple remittance addresses for each vendor. A single check is issued for all invoices being paid to each unique vendor/address.

-

Daily invoice entry reports, listing all invoices posted since the last daily update. Daily reports are produced by invoice, or by general ledger account number (in both detail and summary format).

-

A cash requirements report, which forecasts anticipated payable obligations based on a combination of invoice due dates and check processing dates.

-

An Accounts Payable Aging report, which uses flexible, user-defined aging buckets to classify payable obligations by invoice date.

-

Complete void check processing, including reinstatement of all invoices (and credit memos) covered by the check, as well as reversal of the cash-A/P transaction in the general ledger. Checks issued in prior periods may also be voided.

-

Standard year-end processing, including production of 1099 forms for all qualifying vendors.

TRAFXS Systems - System Administration

System Administration

TRAFXS System Administration Solution

The TRAFXS security facility permits the system

administrator to flexibly restrict programs to those users (or groups

of users) who require access. This is accomplished by definition of

'security groups', into which any number of users may be enrolled. A

user may be a member of any number of groups.

The TRAFXS menu facility, a three-level tree

structure, can be customized for any user. Each menu entry may be

restricted (by the system administrator) to a single group or user;

individuals without access never see the menu selection on their

screen.

Users may define sequences of reports (with

pre-determined sort and selection parameters) that they wish to

repeatedly execute. Simply requesting a report sequence (represented by

a six-character code) and a destination (print) device can trigger a

sequence of several reports comprised of hundreds of pages.

Data archiving and purging is also completely

under the control of the system administrator. Historical information

in different subsystems can be independently purged through a limiting

date. Audit trails are automatically printed for all purged records.

Additional Features

-

Security group and menu definition listings which may be produced in varied formats. These documents assist the system administrator, and simplify integration of new applications into the TRAFXS system.

-

Report dictionary maintenance and list facilities, which permit the systems administrator to add new reports into the TRAFXS system. Only reports in the dictionary may be included within a user-defined sequence.

-

Print devices may be added and/or re-configured at any time by the system administrator. Newly-added devices automatically appear in device menus when a report (sequence) is requested by an operator.

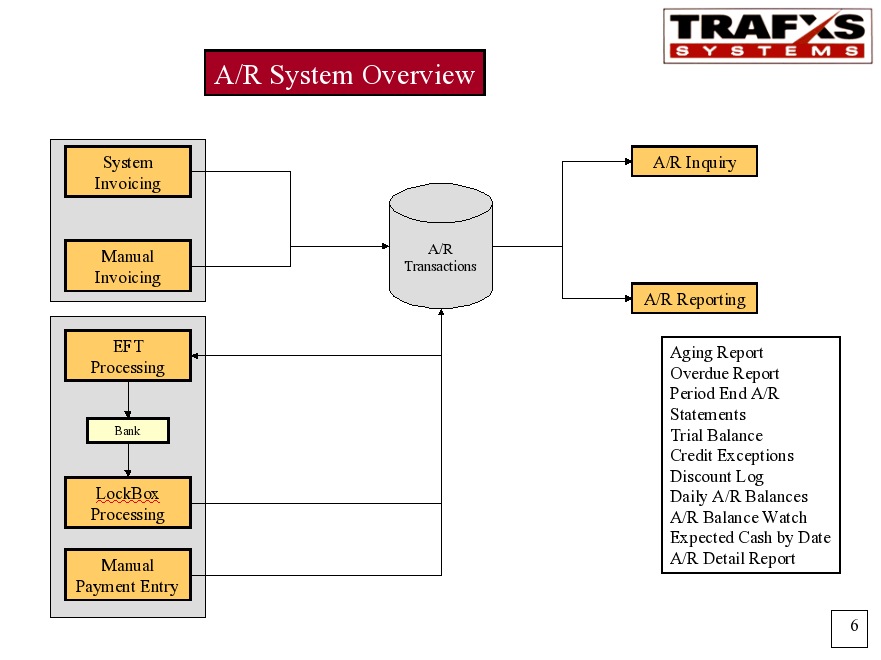

TRAFXS Systems - Accounts Receivable

Accounts Receivable

TRAFXS Accounts Receivable Solution

The TRAFXS Accounts Receivable subsystem is

completely integrated with several other subsystems within the

application, including Invoicing, General Ledger, Contract Management,

Rebates, and Exchanges.

Invoices and credit memos are updated to accounts

receivable only after an appropriate audit register is printed.

Invoices and credit memos may also be manually posted, along with their

general ledger distributions.

Invoices may be associated with an individual

customer, or with a specific contract. All reports provide the option

of contract sub-totals.

Payment entry is both efficient and flexible.

Incoming checks may be distributed against outstanding invoices either

manually or automatically. When done by the program, invoices may be

selected for payment by date (chronologically) or by contract.

Intercompany transactions, whether arising as a

result of invoice posting or payment entry, automatically generate

offsetting entries to retain the G/L balance in each company.

Additional Features

-

Daily invoice entry reports, listing all invoices manually posted since the last daily update. Daily reports are produced by invoice, or by general ledger account number (in both detail and summary format).

-

Statement printing, either on a batch basis, or by individual contract or customer. The aging buckets appearing at the bottom of the statement are user-defined.

-

A/R aging report, based on the invoice due date. As with statements, the aging parameters are user-defined and may vary between instances of the report.

-

Accurate historical reports. Statements and the aging report may be printed at any time for a specific date; the results appear as they would have on that date.

-

A powerful inquiry facility, supporting requests by customer or individual contract. Either outstanding or all invoice balances may be chosen, and for any range of dates. A single function key displays payment (and discount) history for an invoice.

-

Manual or automatic discount processing. A history of discounts taken is also retained. Exception reports listing unearned discounts taken, or earned discounts not taken, may be printed for use by the credit department.

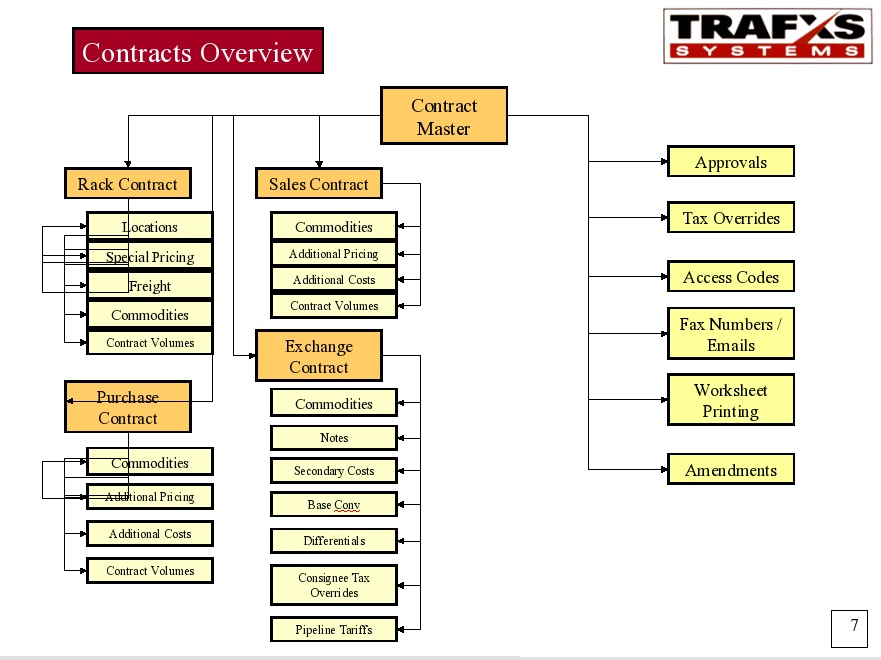

TRAFXS Systems - Contract Management

Contract Management

TRAFXS Contract Management Solution

Five different types of contracts - Sale,

Purchase, Exchange, Buy/Sell, and Rack-lifting agreements - are

supported within TRAFXS.

All relevant information pertaining to a contract

is retained, including effective period, products, locations, contract

value, additional costs, secondary costs, differentials, and price

formulas.

Contracts are automatically forwarded for review by credit and accounting before transactions may be processed against them.

Contract value is automatically re-calculated

every evening based on current posted prices. Excessive variations, or

those which surpass customer credit limits, are immediately reported to

the credit department.

Additional Features

-

Formal contracts and worksheets, both of which may be printed at any time.

-

Support of both light-end and heavy-end products (including crude). Commodities may be arbitrarily grouped for reporting and statistical purposes.

-

Deliveries and receipts both retained on exchange and buy/sell agreements; effective period, locations, products, and prices may vary by direction.

-

Prices for contracted products may be specified as fixed values or formulas, which may be effective at all locations, or just a single location, at which a product is sold.

-

Rapid generation of contract amendments, including the ability to construct and/or evaluate an amendment while the original contract remains in effect.

-

Contract log, listing contracts numbers, value, products, and locations, using a flexible set of selection criteria.

-

Up to 26 standard or user-defined endorsements (notes) permitted in contract entry; these routinely appear at the bottom of printed contracts and worksheets.

-

Extended descriptions of several items, e.g. quality, inspection, and method of delivery, are referenced by user-defined 3-character mnemonic codes.

-

Comprehensive contract search and inquiry facilities, which have been made available throughout the TRAFXS system.

TRAFXS Systems - Contract History

Contract History

TRAFXS Contract History Solution

TRAFXS provides extremely flexible inquiry and

reporting tools for operators who request historical sales, purchase,

and exchange information. Information can be displayed by contract or

company, and filtered by location and/or product.

Locations may be reported individually or

consolidated. Products may be reported individually or accumulated for

specific product groups or families.

Month-to-date and year-to-date values can be

reported in a variety of units; the program supports barrels (volume),

tons (volume), dollars (sales/purchases), barrels per day, average

dollars per barrel, and average cents per gallon.

Contract history also includes a projection

system for rack sales, in which anticipated sales volumes can be posted

by location and product source. These are subsequently compared on a

day-to-day basis with actual rack sales.

Reports & Inquiry Facilities

-

Sales (purchase) summary report, which lists sales (purchases) over a 12-month period, either by month or quarter.

-

Sales comparison report, which compares actual month-to-date, year-to-date, and contract-to-date sales against original contracted volumes.

-

Contract sales (purchases) inquiry, which displays actual sales (purchase) volume and dollars for a requested set of locations and products.

-

Monthly sales (purchases) inquiry, which displays actual sales (purchase) volume, dollars, and net costs for a requested location and product.

-

Exchange inquiry, which display month-to-date and year-to-date deliveries and receipts by product and location. Deliveries and receipts are placed side by side for easy reading.

-

Month-to-date rack sales report, which summarizes and prints volumes for all light-end products for each contract and/or customer.

-

Volume inquiry, identifying all products pulled in a single month by any individual customer (contract).

TRAFXS Systems - Pricing

Pricing

TRAFXS Pricing Solution

Price tables are supported for multiple pricing entities. Prices for specific products may vary by location.

Posting of prices takes place on an as-needed

basis. Prices may be specified as explicit values, or as changes to the

prior posted price. Retroactive price changes are permitted, and

pricing of individual products may easily be discontinued at a specific

location.

New prices may be posted several times within a

single day. When invoicing, both the lift date and time are used to

determine the price in effect at the (date and) time of sale.

An effectiveness-limiting date and time may be

indicated when posting prices. Transactions whose lift date/time occurs

later than the indicated date/time are flagged during invoice

processing.

Additional Features

-

Optional selection of six 'standard' products per pricing entity. Standard products are priced very quickly over a set of locations.

-

Maintenance of gravity tables in conjunction with crude pricing methods.

-

Price worksheets may be printed before, during, or after actual price posting. This permits the report to be employed as an input, edit, or audit document.

-

Price lists may be configured to include estimated discounts and/or superfund levies.

-

Comprehensive on-line price history, which may be requested from several places within the TRAFXS application. This powerful facility provides four types of information:

-

Complete price history for a specific product/location

-

List of prices of a specific product at all locations

-

List of prices of all products at a single location

-

List of prices of a specific product in a geographic region

-

-

Flexible, easy-to-learn, price formula syntax. Formulas may be used during contract entry for product prices, differentials, and exchange contract settlement terms.

TRAFXS Systems - Invoicing

Invoicing

TRAFXS Invoicing Solution

Invoicing processes validated movement

transactions, producing a set of daily and M-T-D reports, and printing

invoices. A single invoice may be printed for all billable movements on

a single bill of lading or for all billable movements in a specific

location on a single day (gang billing).

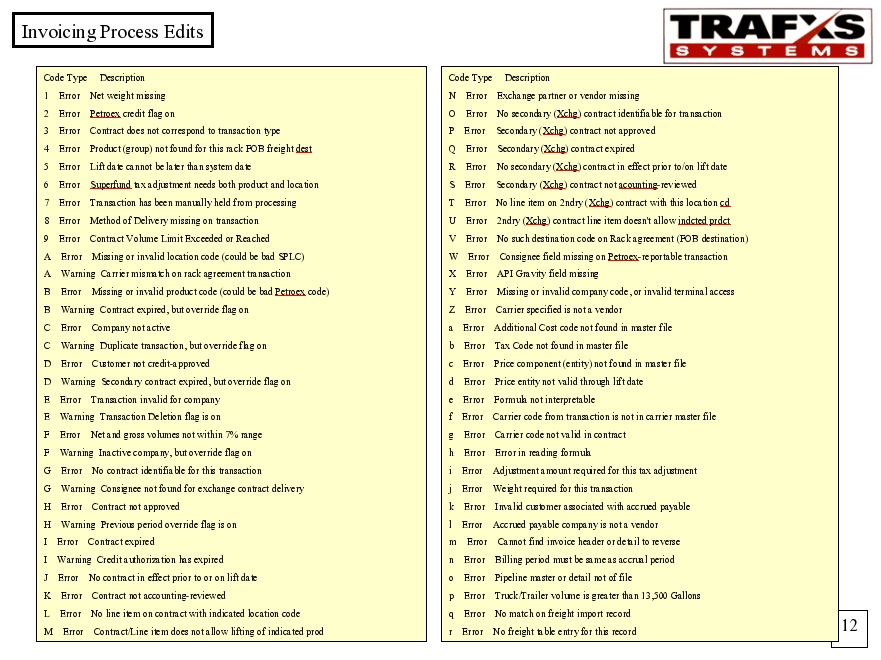

Another 16 validation steps are applied to all

billable transactions, including formula integrity, validity of freight

vendors, and accuracy of taxation terms. Movements not passing this

validation are also extracted to another batch to await examination and

editing.

The invoicing process is completely restartable.

The selection and sequence of both daily and M-T-D reports is

user-defined, and may vary as a month approaches closing.

Transactions within two accounting periods may be

processed simultaneously; all reports distinguish information by

accounting period. Sales may be accrued, pending actual billing at a

later date.

Additional Features

-

Daily control report, providing a one-page summary of daily invoicing activity.

-

Invoicing transaction error log, indicating a list of all invalid transactions, as well as the source of the error.

-

Automatic determination of all additional costs (e.g. freight), as well as calculation of all applicable taxes associated with the sale.

-

Daily invoice report, at both detail and summary level, which provides an audit trail for the day's invoicing activity, and subsequent update to accounts receivable.

-

Daily sales journal report, suitable as an audit trail for updates to the general ledger from the invoicing subsystem. The report includes entries for product sales, miscellaneous charges, taxes, as well as the accounts receivable offsets.

-

Automatic generation of anticipated payable transactions (tickets) associated with billable sales; these are sent to the 'ticket-matching' section of the TRAFXS application, where they are matched to incoming invoices.

-

Optional redirection of invoices to an archive device (as well as the printer) in order to accommodate long-term storage and retrieval requirements of invoices (e.g. microfilming). Invoices may also be sent to a centralized exchange facility (e.g. DTN).

-

Comprehensive on-line invoice and bill of lading history inquiry capabilities. These may be invoked from several points within the TRAFXS application.

-

Billing method (gang or single BOL) may be configured by customer.

TRAFXS Systems - Exchanges

Exchanges

TRAFXS Exchanges Solution

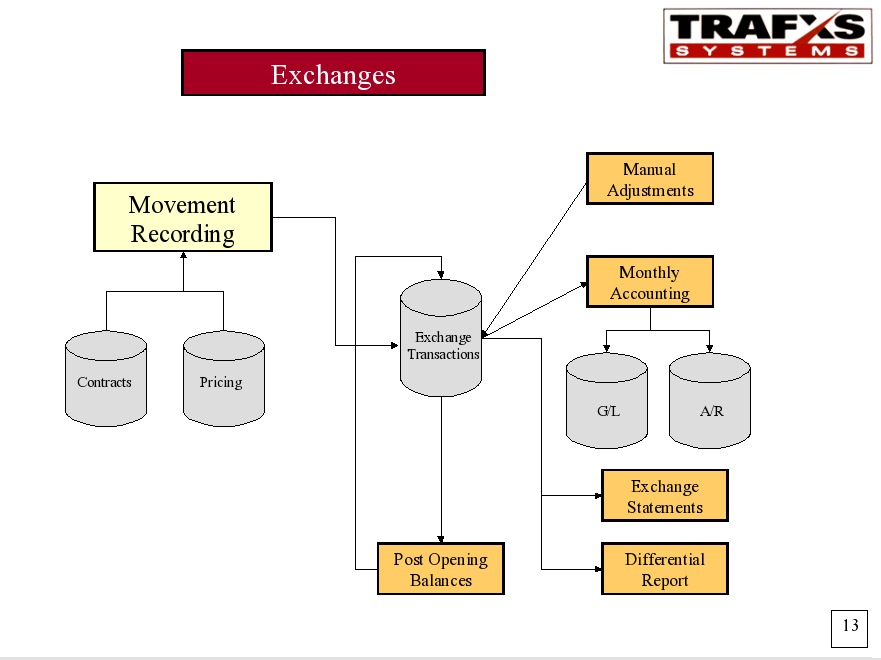

The exchange subsystem processes daily receipts

and deliveries to yield current balances for all products specified in

a contract. Balances are maintained and reported by base product;

exchange history by actual product may be retrieved using Contract

History programs.

The exchange system also produces month-end

statements for all partners. Summarized on the statement are deliveries

and receipts (by base product and location), regrades, adjustments, and

balances. Differentials are calculated for each transaction, and

accumulated on the statement.

The system also supports exchange contract

settlements, in which the agreement is closed, and outstanding balances

are valued to yield a net financial position between partners.

Additional Features

-

Open-ended definition of differentials associated with each product/location combination. Each delivery (or receipt) corresponding to this product and location is assumed to generate the indicated differentials.

-

Line loss percentages by location; these are reported on the exchange statement.

-

Daily exchange control reports, which indicate (on both a detailed and summary basis) volumes of all products delivered and received on exchange during the day.

-

M-T-D exchange control reports, which indicate (on both a detailed and summary basis) volumes of all products delivered and received on exchange during the month.

-

Extensive exchange adjustment facility, in which regrade or differential (miscellaneous) adjustments may be posted at any time during the processing cycle. Adjustments are logged on a register at month-end, and appear on exchange statements.

-

Assignment of invoice numbers for exchange and settlement statements; balances on these statements are automatically updated to accounts receivable. An exchange register provides the required audit trail.

-

Automatic update of exchange and settlement statement detail to the general ledger. A G/L distribution report, which serves as an audit trail for these journals, is produced as part of exchange processing.

TRAFXS Systems - Movement Recording and Processing

Movement Recording and Processing

TRAFXS Movement Recording and Processing

Inventory movement may be recorded manually, or

directly from multiple user-defined sources, one of which may be

Petroex transmissions. Other transaction sources which automatically

transmit movement information include automated loading racks and

terminals.

A cross-reference file of access codes (consignee

numbers) automatically locates the contract against which the movement

takes place, as well as the exchange source (if any).

Up to 35 validity checks are performed upon

receipt of a transaction, including data integrity, customer and

contract accuracy, and credit worthiness. Invalid transactions are

extracted for examination, allowing the remaining movements to be

billed at the earliest opportunity.

Transaction Types Supported

-

Direct sale from wet or exchange inventory

-

Exchange delivery from wet or exchange inventory

-

Pipeline and truck transfers

-

Purchases or exchange receipts into wet inventory

-

Product, volume, price, tax, or freight adjustments

-

Outright reversal of a previously-billed invoice

-

Exchange settlements

Additional Features

-

Listing and validation of externally-supplied inventory movement information. Each incoming batch produces an audit list, which may be certified against control totals supplied.

-

Automatic conversion of external location and product codes, for instance Petroex-supplied SPLC and commodity identifiers, to standard, internally-used values.

-

Inquiry upon externally-supplied transactions even before invoicing takes place.

-

Configurable cut-off times for each individual terminal.

-

Flexible addition of external movement recording information sources.

-

Efficient transaction entry and editing procedures, including automatic prompts for transaction type-specific fields in pop-up windows.

-

Transaction logs produced for all batches, clearly listing error codes, warning indicators, and duplicate transactions.

TRAFXS Systems - Tax Reporting

Tax Reporting

TRAFXS Tax Reporting Solution

By default, all applicable federal, state, and

local taxes are automatically applied to any sale or receipt

transaction. However, TRAFXS supports an exemption facility, in which a

customer holding a valid certificate is exempt from all taxes covered

by the document.

Applicability and/or exemption of a specific tax

may also be designated at the contract level. This is useful when the

tax depends upon the usage, not the identity or purchase location, of

the products.

Tax rates are maintainable at all times, and may

be posted well in advance of their actual effective date. Associated

with each tax is the jurisdiction in which it is collected, the

products to which it applies, and the certificate types which exempt

it. Certain taxes may be also apply to additional costs (e.g. freight

or handling charges).

Several reports are available on a periodic basis

for tax reporting and analysis. These reports are compiled from files

produced by the invoicing system.

Additional Features

-

Inventory transfer tax report, which identifies all sales in a specific month which cross a state boundary before title is transferred.

-

Product receipts tax report, which identifies all purchases and exchange receipts in a specific month in which title transfer occurs within an individual state jurisdiction.

-

Sales tax report, which identifies all taxable and exempt sale and exchange delivery transactions in a specific month in order of tax code.

-

Tax sales summary report, which indicates the M-T-D tax collected for each individual tax type, as well as the total basis (volume or dollar amount) upon which the tax is calculated.

-

Sales summary by FOB location report, which summarizes all sales in a specific period (which may be several months) by the state, and optionally by customer, in which title of the product was transferred.

-

Exchange tax statements for exchange partners allow for tax payments and/or deposits as many cycles per month as needed.

-

Tax source summary report, which summarizes each tax code based on the source and status of the transaction. This report is commonly used for estimating tax deposits.

TRAFXS Systems - Rebates

Rebates

TRAFXS Rebates Solution

Market conditions occasionally soften rack

prices; when this occurs, customers may negotiate rebates with the

supplier. TRAFXS supports a comprehensive rebate subsystem, including

the ability to divert rebates to brokers.

Rebates may be flexibly defined. A single rebate

may encompass activity on several contracts, and may be comprised of

several 'items'. Each rebate item identifies an effective period, and a

set of products, locations, and terms.

When processing rebates (generally at month-end),

all invoiced transactions generated during the month are examined to

determine if they can be classified under the terms of a rebate. Terms

may be manually overridden, to allow for shortage and other exception

conditions.

Each rebate issued generates a credit memo; these

are later automatically posted to accounts receivable, with their

complete detail automatically posted to the general ledger.

Additional Features

-

The ability to designate special terms for a portion of the month, and optionally provide those terms to sales associated with a single contract only.

-

Batch calculation of rebates, normally done at month-end. The rebate calculation report prints the results of these computations. The actual rebate awarded may be manually overridden.

-

Rebate detail report, which lists all transactions determined to be rebate-eligible for each individual contract.

-

Rebate statement, which summarizes the set of rebate-eligible transactions for each contract, displays the actual rebate awarded on an item-by-item basis, and provides overall rebate totals.

-

Assignment of credit memo numbers for rebate statements; balances on these statements are automatically updated to accounts receivable. An rebate register provides the required audit trail.

-

Automatic update of rebate transaction detail to the general ledger. A G/L distribution report, which serves as an audit trail for these journals, is produced as part of rebate processing.

-

Rebate history reports, which extract and print rebate information, on either a detailed or summary level, for historical periods.

TRAFXS Systems - Credit Processing

Credit Processing

TRAFXS Credit Processing Solution

A broad set of credit and treasury controls have

been incorporated in the TRAFXS system. These include approval of both

customers and contracts, daily monitoring of contract values based on

commodity market prices, and letter of credit processing and

monitoring.

All new customers must be approved by the credit

department. Contracts must be approved by credit and/or treasury before

transactions may be billed against them. Finally, each contract

revision is subject to accounting review, during which accuracy of

formula pricing and other key billing data is verified.

The credit, treasury, and accounting review

processes have been deigned using an in-basket approach, in which each

department can quickly call up a list of all contracts awaiting their

inspection.

The amount of credit assigned to a customer may

be any combination of an open line and letters of credit. Credit limits

are automatically reduced as letters of credit expire.

Additional Features

-

Credit exception report, in which customers meeting any of several credit-related exception conditions can be reviewed. These include credit limit violation, accounts receivable delinquency, and overdue financial statement.

-

Contract exception list, produced nightly, in which each contract is re-valued based on market conditions. Those contracts exceeding posted credit limits are listed for credit review.

-

Letters of credit may be associated with one or more contracts. Letters may be listed and reviewed by customer, financial source (bank), or active months.

TRAFXS Systems - Ticket Matching

Ticket Matching

TRAFXS Ticket Matching Solution

Ticket matching associates incoming invoices with

accrued accounts payable transactions which were previously calculated

as a by-product of movement recording and invoicing. Unmatched tickets,

representing a real, if unbooked, liability, may be posted as accrued

accounts payable to the general ledger.

Ticket matching generally occurs upon invoices

for product purchases and/or freight, and supersedes the standard

invoice entry procedures found in accounts payable. Adjustments in

volume and/or cost made when the invoice is actually received and

matched are automatically posted to contract history.

Selection of tickets to be matched generally

occurs by vendor and bill of lading, both of which normally appear on

an incoming invoice. However, the system also supports ticket selection

by date, location, and contract; this permits accurate processing

should the bill of lading not be available, or if the original

transaction were posted to the wrong vendor.

Batches of matched invoices, after review, are

'released' to the accounts payable system, at which time they pursue

normal processing.

Additional Features

-

Daily matched ticket report, which is produced in vendor or G/L code sequence. When printed in G/L account order, the report provides an audit trail for daily G/L posting from the ticket matching subsystem.

-

Daily matched tickets variance report, in which variations between accrued and actual volumes (or accrued and actual costs) are reported. This report helps verify the accuracy of incoming bills.

-

A flexible ticket-printing report, permitting retrieval of tickets based on status (matched or unmatched), type (product or freight), and date. Here too, variance information is optional.

-

A laid-in cost report, in which product purchase and freight costs are accumulated for each transaction, yielding a net cost per barrel (or ton). Both accrued and actual costs are reported.

TRAFXS Systems - Financial Report Writer

Financial Report Writer

TRAFXS Financial Report Writer Solution

The Financial Report Writer gives TRAFXS users

the ability to design and print columnar reports based on the general

ledger. Reports may be printed for any month, quarter, or year in the

4-year fiscal calendar.

Standard column headings are determined by the

program, but may be overridden when designing the report. Reported

columns may contain general ledger balances (dollars or volume), budget

values (also dollars or volume), percentages, variances, totals, or

other calculations.

Reports can consolidate values for any of the

four general ledger account segments (company, major, intermediate, and

detail). This feature permits the report designer to easily merge, for

example, multiple companies, multiple locations within a single

company, or multiple products within a single location.

Report definitions are saved for repeated use. An error-checking facility examines reports for definition problems.

Users may define (and retain) sequences of

financial reports that they wish to repeatedly execute. Simply

requesting a report sequence and a destination (print) device can

trigger the production of several financial reports.

Additional Features

-

Flexible, user-defined heading and footing lines which frame each page of a financial report. Headings may contain information determined at run time, e.g. month name, quarter.

-

Complete user control over placement and width of columns, precision of calculated fields, and the format of headings and sub-totals. This enables presentation-quality financial reports to be produced in virtually any layout desired.

-

Utilities which promote simple report construction, including the ability to quickly copy and modify existing report definitions.

Documentation

TRAFXS Systems - General Ledger Documentation

TRAFXS - General Ledger

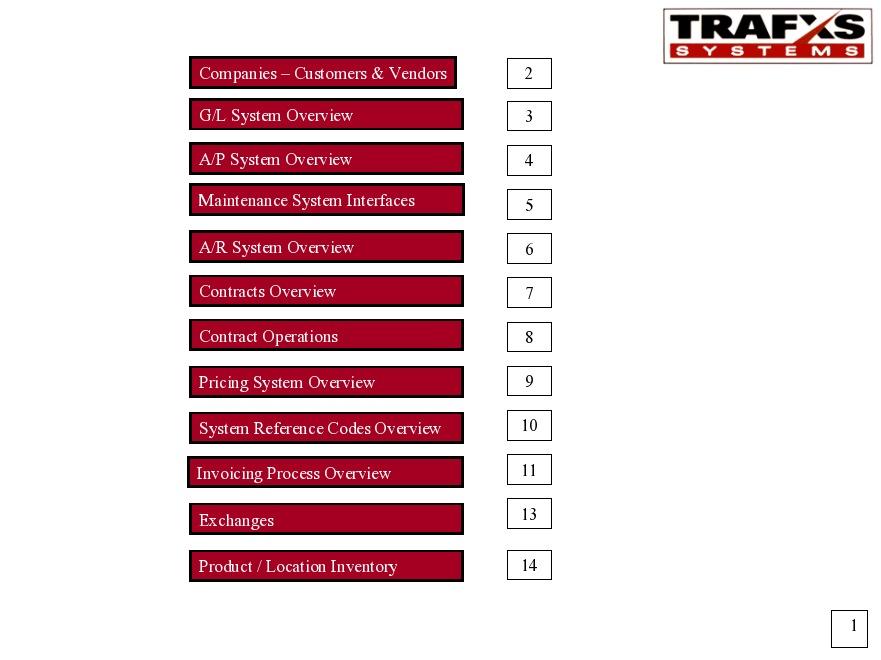

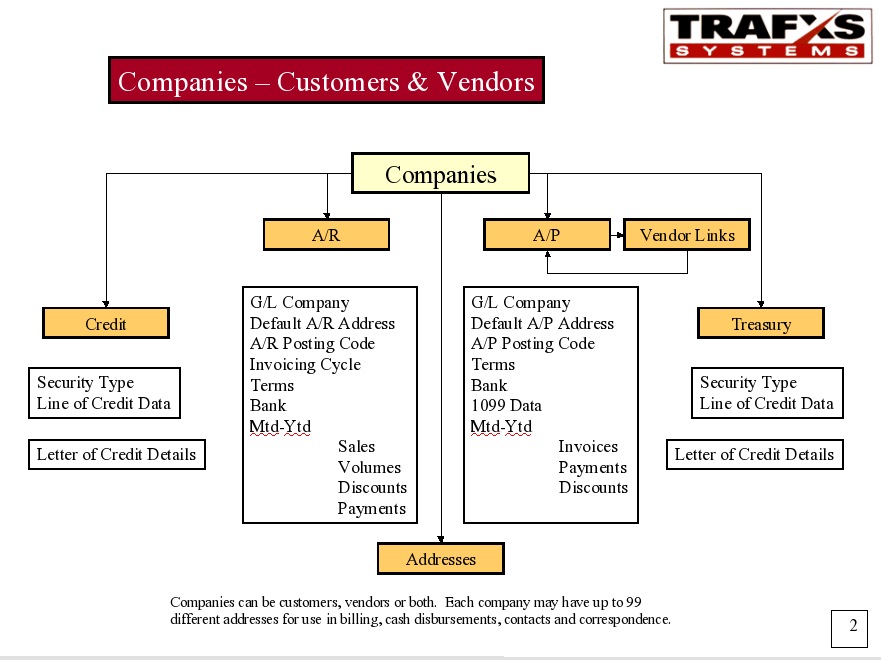

TRAFXS - Companies - Customers & Vendors

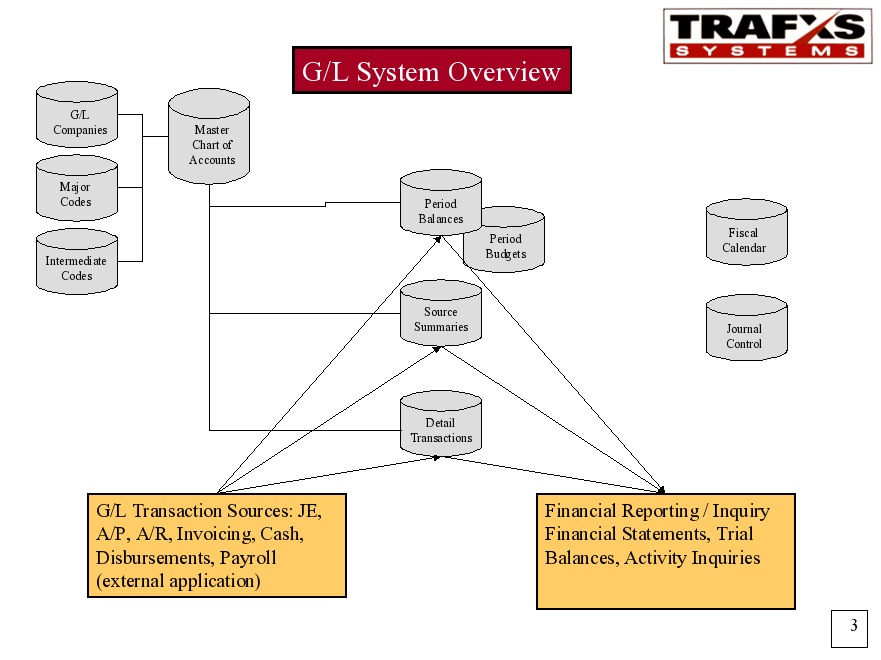

TRAFXS - General Ledger System Overview

TRAFXS - Accounts Payable System Overview

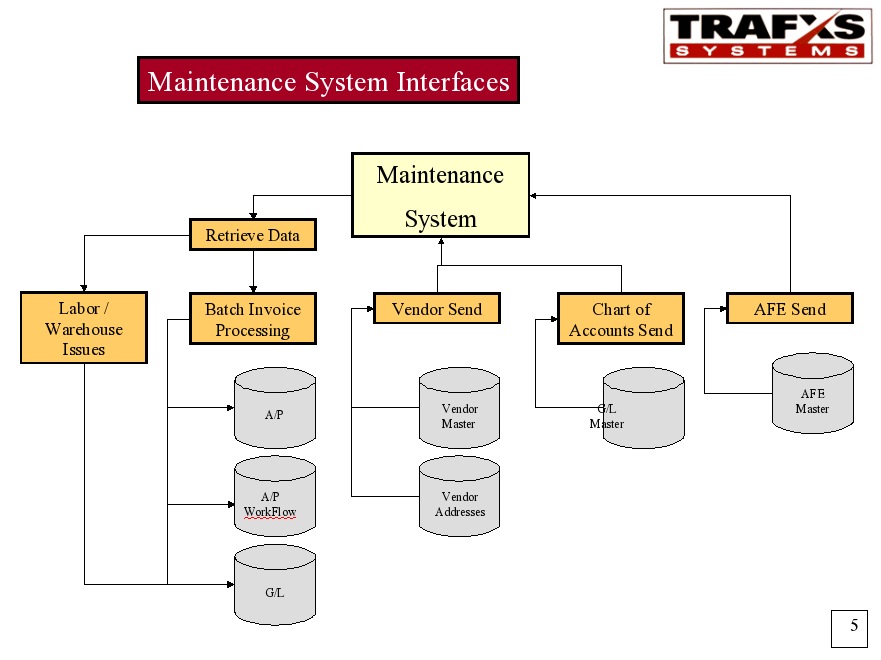

TRAFXS - Maintenance System Interfaces

TRAFXS - Accounts Receivable Overview

TRAFXS - Contracts Overview

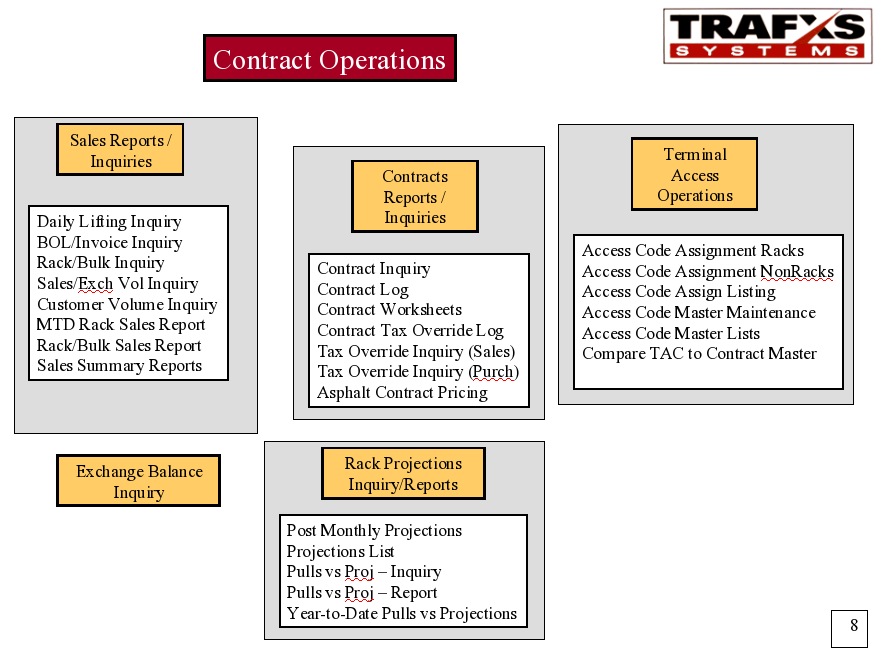

TRAFXS - Contract Operations

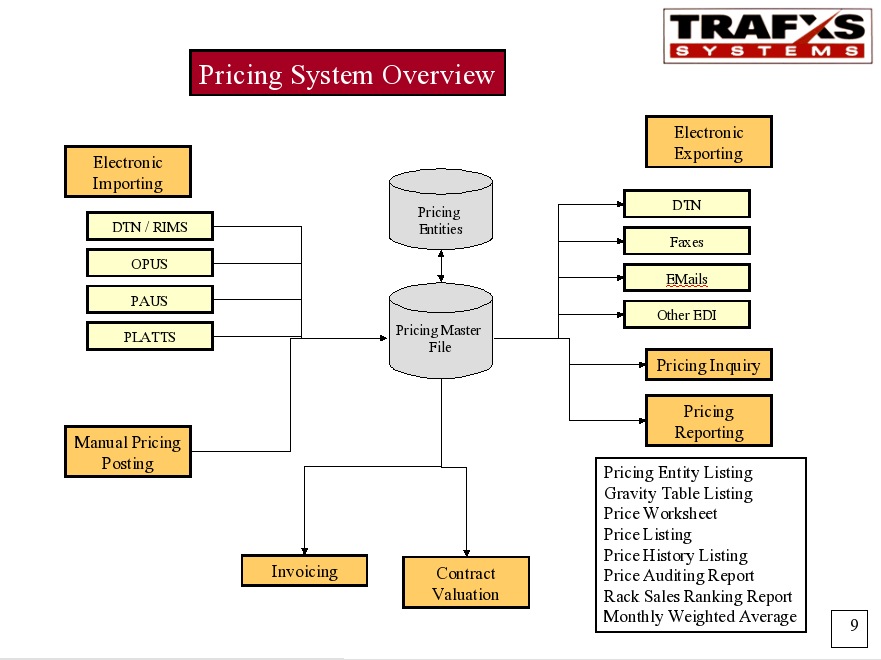

TRAFXS - Pricing System Overview

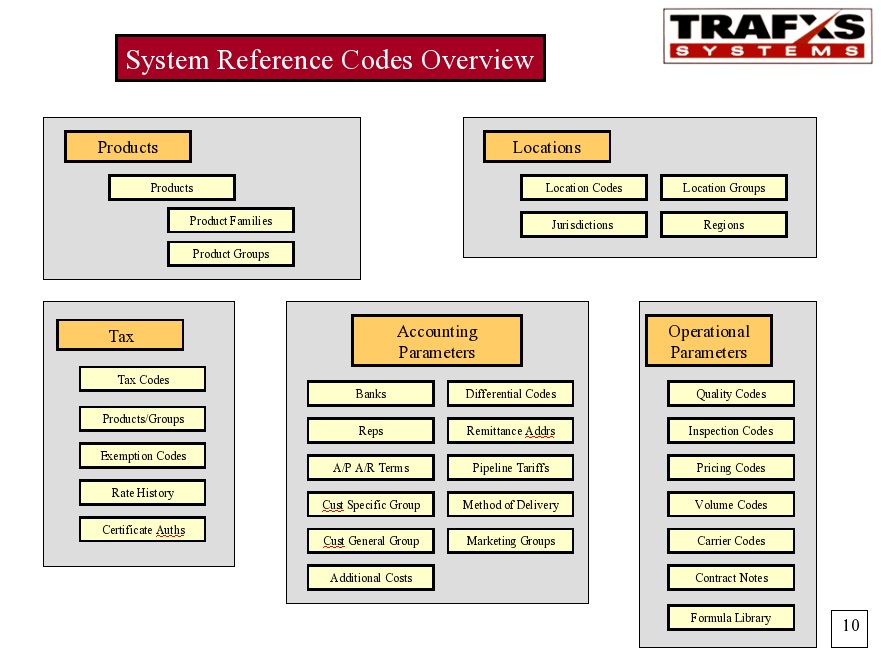

TRAFXS - System Reference Codes Overview

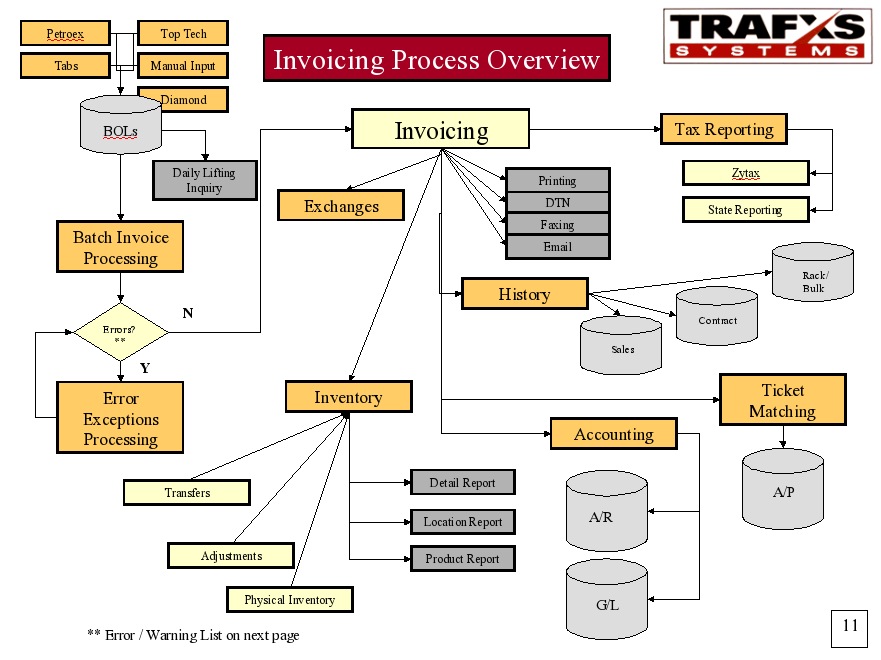

TRAFXS - Invoicing Process Overview

TRAFXS - Invoicing Process Edits

TRAFXS - Exchanges

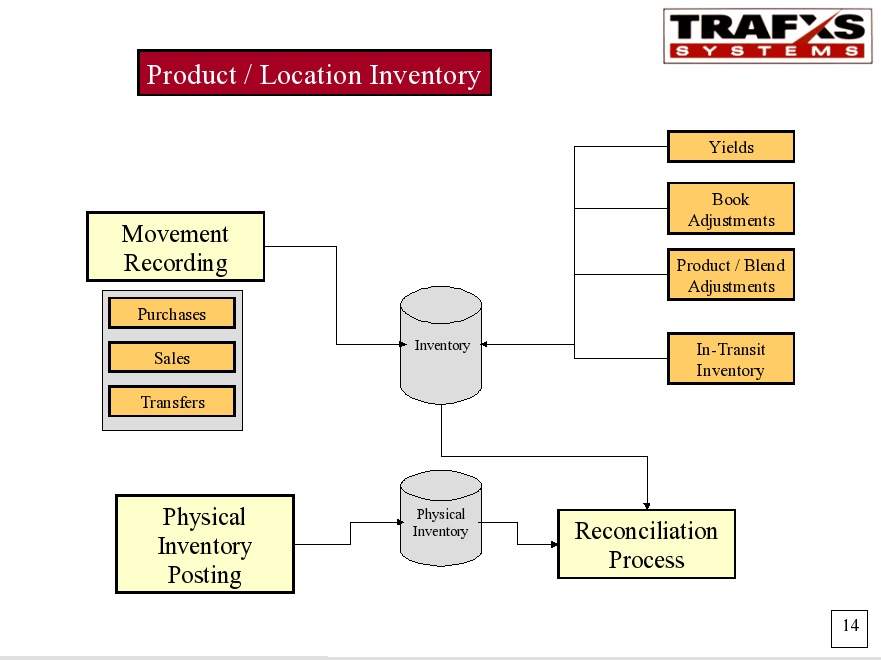

TRAFXS - Product Location Inventory